We’re Watching

USD 39.03 USD 0.52 1.35%

XPEV is attempting to bounce off a key support level at USD 38.35, going back to February. Upside momentum and volume have started to pick up. There could be a decent set up for an upside reversal and continuation of the May rally.

Xpeng is one of the few Chinese EV makers to be dual-listed in NYSE and HKEX. The HK listing increases its investors base with qualified Chinese investors allowed buy its stock in HK.

HKD28.40

+ HKD0.15

+ 0.53%

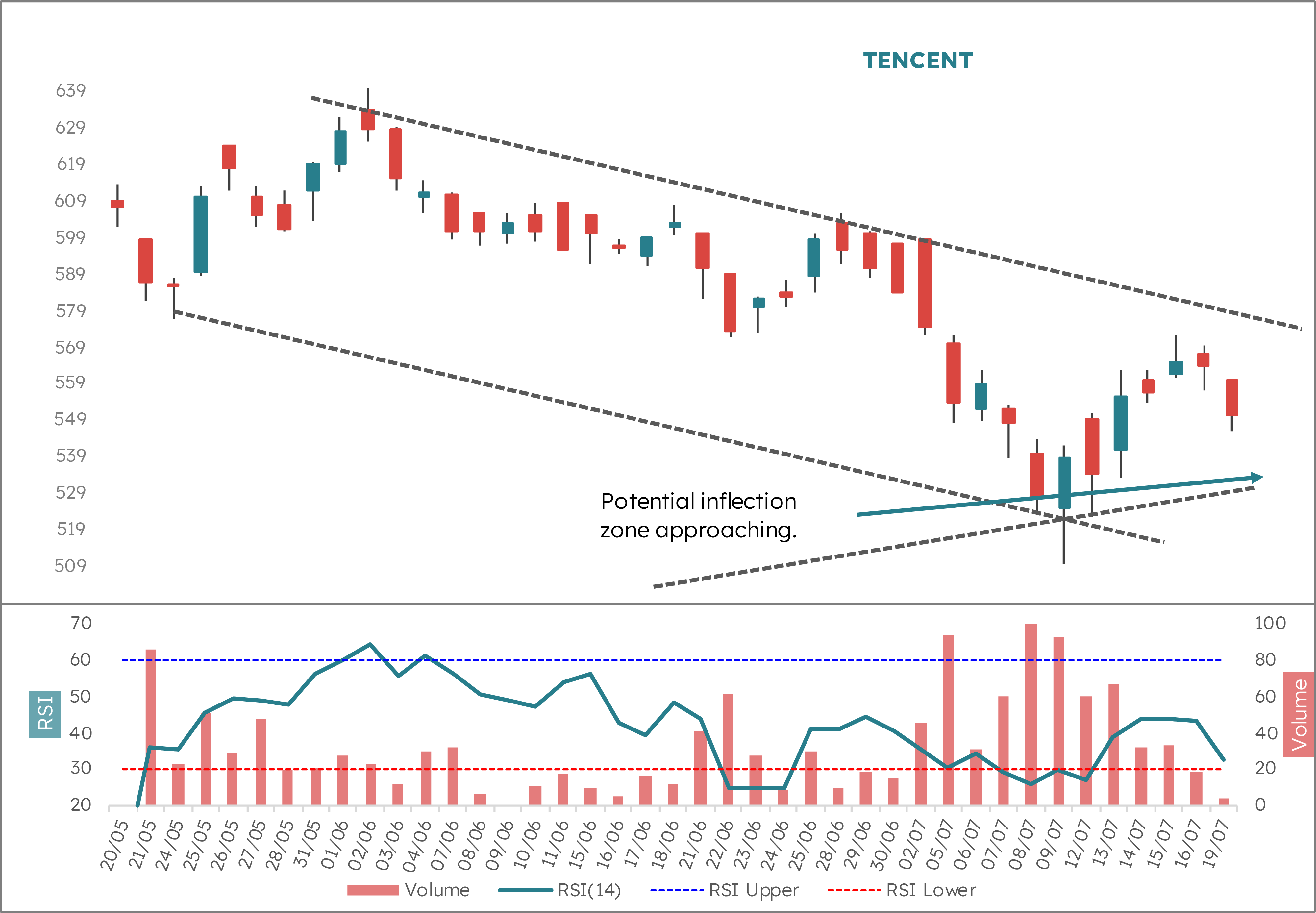

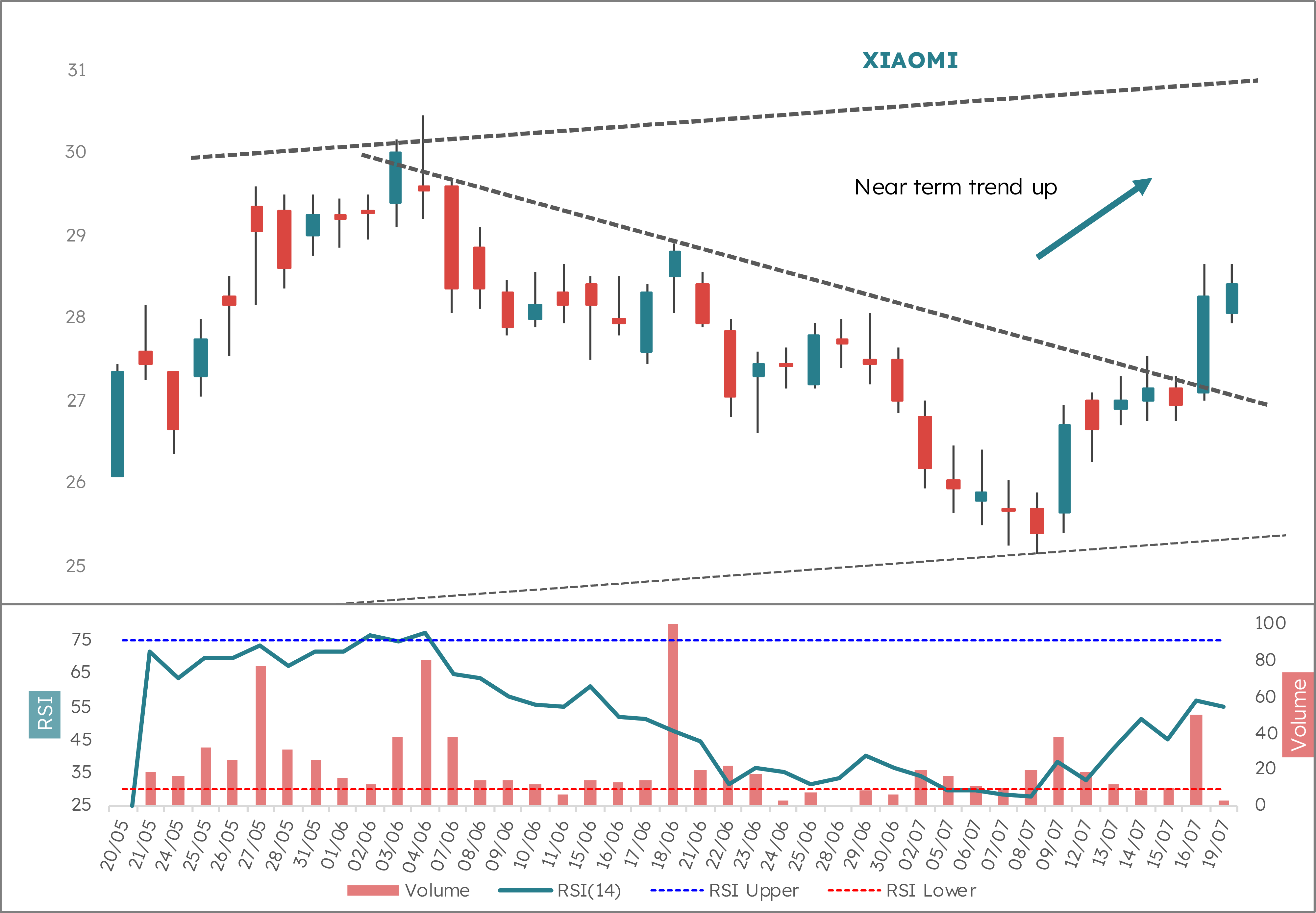

In the intermediate-term, Xiaomi is technically quite fragile with low upside power since mid-March. But the current uptrend channel top is HKD31.32, a reasonable near-term target before re-evaluation.

China’s Xiaomi is know for its cheap smartphones around the world. It also produces numerous smart hardware devices powered by its AI and Internet of Things platform. Mostly recently in 1H2021, Xiaomi said it was moving into EVs.

SGD 3.86

+ SGD 0.05

+ 1.31%

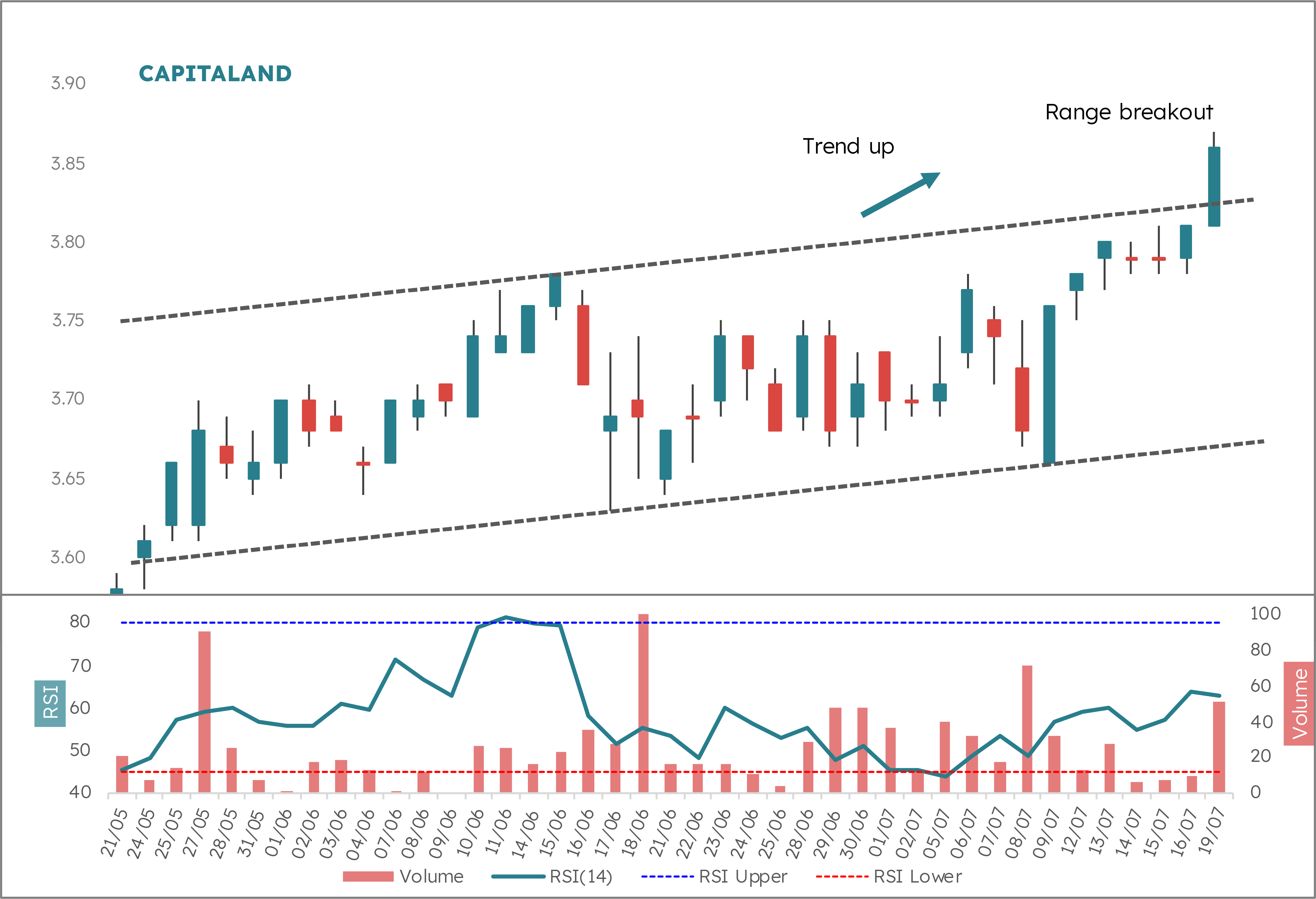

Price has been consolidating since March but has just started to break out aggressively. The level to beat is the March high of SGD3.912 and it will be blue skies.

Singapore’s CapitaLand is a diversified property company involved in residential, commercial, and industrial property development and management. It is restructuring to become a become a pure real estate investment manager under CapitaLand Investment Management (CLIM).

$137.402.441.81%

SGD1.80

– SGD0.01

– 0.55%

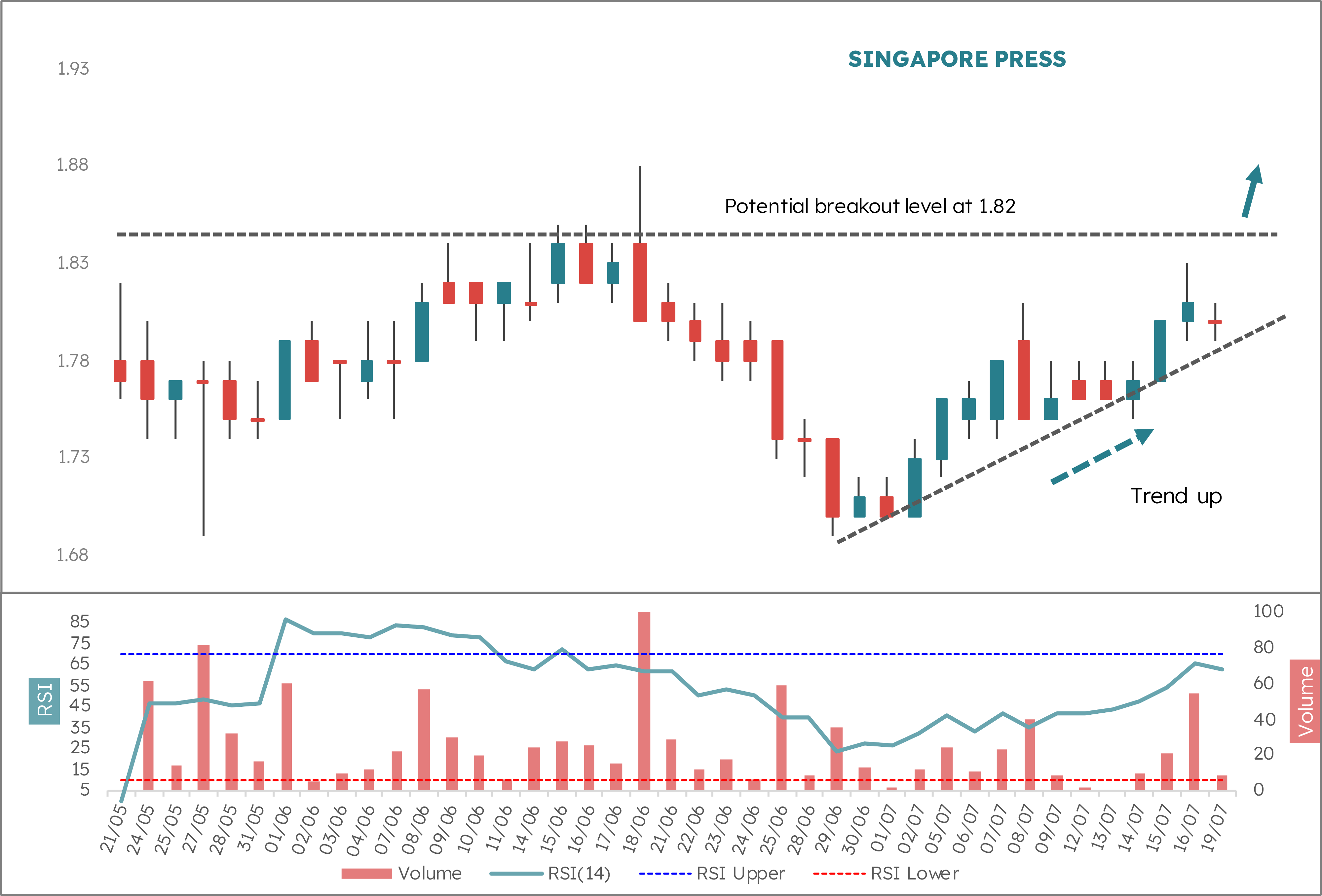

Mid-term up trend with potential breakout level at SGD 1.82. Longer-term target is the April high of SGD 1.967.

Singapore’s SPH begin as a media company in 1984 but has increasingly diversified into property amid declining readership. It’s property investments include a listed REIT, student accommodation in the UK and Germany and aged homes in Singapore and Japan. SPH kicked off a process in May 2021 to give away its declining media assets and focus on its real estate investments.

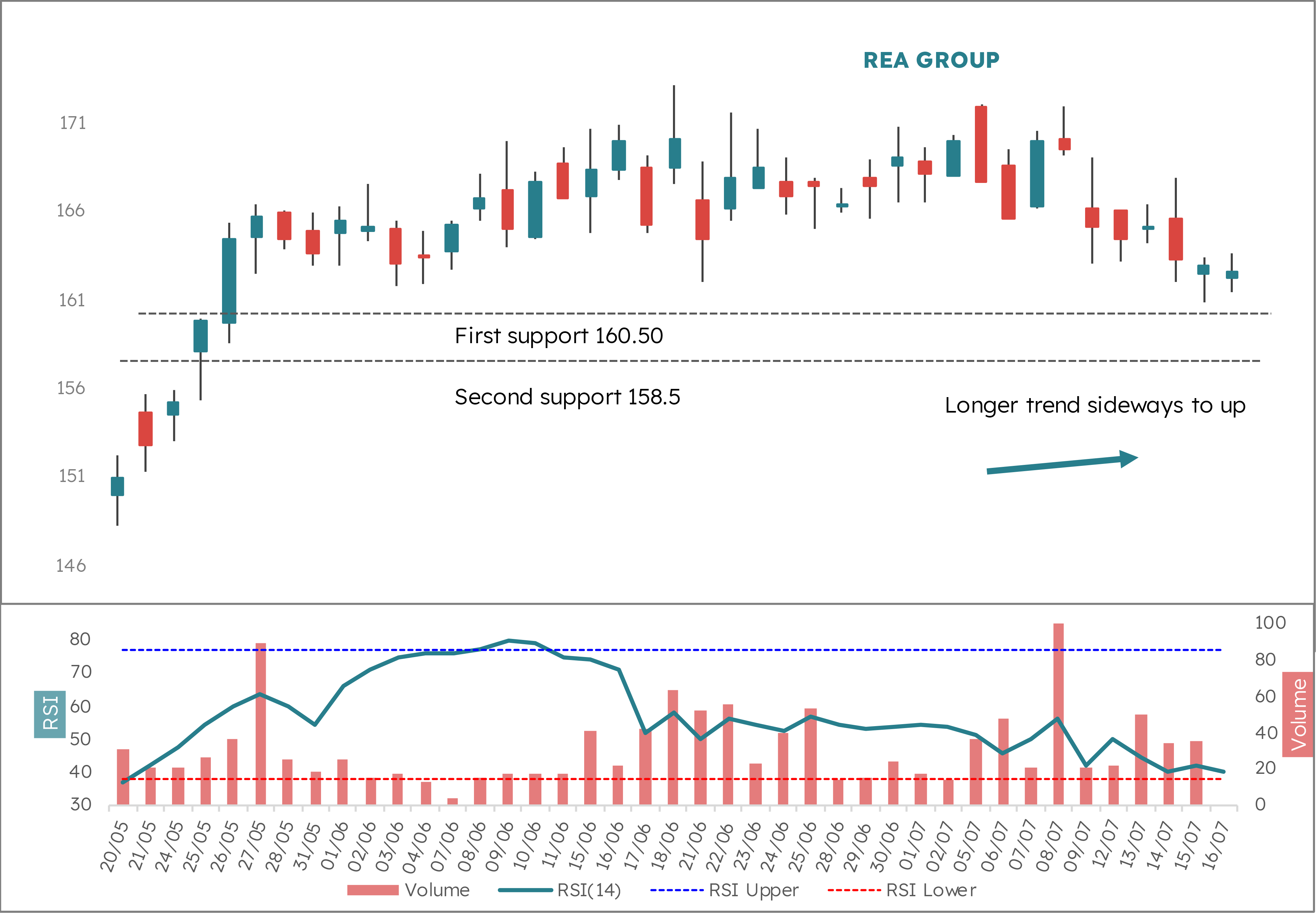

AUD159.02

– AUD3.43

– 2.11%

The stock has just broken near-term support and the price path is down for now The longer-term trend may also have started to turn bearish.

Australia’s REA Group is a digital media business for property – commercial and residential. Beyond its shores, REA owns portals in several countries including Hong Kong, India, Indonesia, Singapore, and the US.

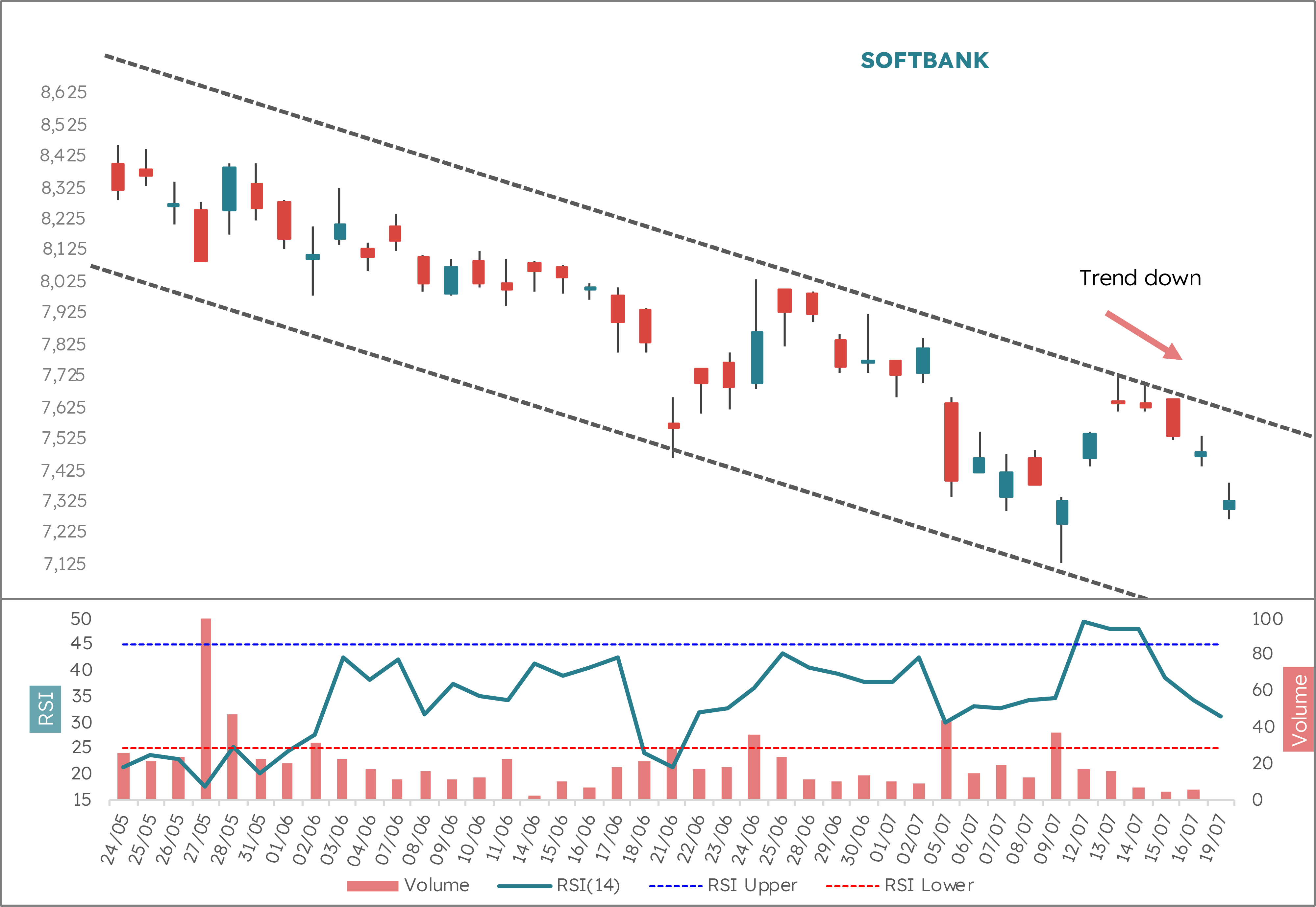

JPY7,330

– JPY151

– 2.02%

Price just failed at the top of the May channel, which is negative. The broad trend remains down and there is no sign of an upside reversal. A key support level to watch is around JPY 6,475.

SoftBank Group provides telecommunications services in Japan but is more famous as an investor of info-tech companies across various sectors including robotics, rideshare, biomedicine, finance, and agriculture. Its investments contain a fair share of hits (Alibaba, Coupang) and misses (Snapdeal, WeWork), and there’s no telling where the next investment sits.

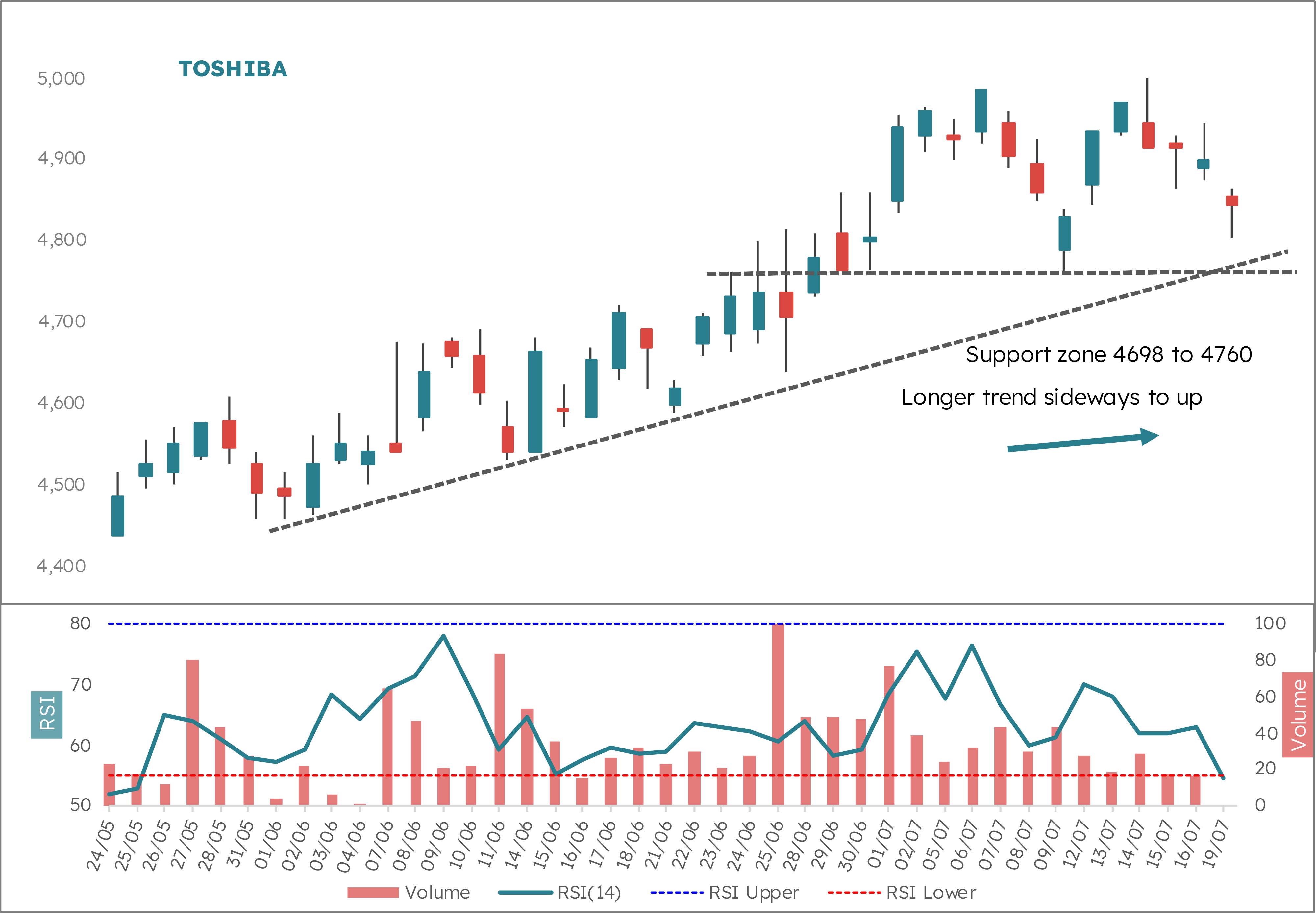

JPY 4,845 ,900

– JPY 55

– 1.12%

Stock in sideways consolidation in the near-term. Once it stabilises in the support zone of JPY 4,698 – JPY 4,760, there should be a resumption in the uptrend. If not, there is a high potential for a downside extension.

Japan’s Toshiba is involved in a myriad of businesses including nuclear and thermal power gen systems, semiconductors, medical equipment and home appliances. It is under intense scrutiny following various scandals over the years, with the latest being alleged collusion with the government to suppress shareholders. It has pledged an internal review, as bidders wait in the wings.